The Basic Principles Of Insurance Agency In Jefferson Ga

Wiki Article

All about Business Insurance Agent In Jefferson Ga

Table of ContentsThe Best Strategy To Use For Insurance Agency In Jefferson GaThe Facts About Life Insurance Agent In Jefferson Ga RevealedRumored Buzz on Insurance Agent In Jefferson GaNot known Facts About Life Insurance Agent In Jefferson Ga

According to the Insurance Details Institute, the average annual cost for an automobile insurance plan in the United States in 2016 was $935. 80. Typically, a single head-on accident can cost hundreds of dollars in losses, so having a plan will certainly set you back much less than spending for the accident. Insurance also aids you stay clear of the decline of your automobile. The insurance coverage safeguards you and aids you with cases that others make versus you in accidents. The NCB may be supplied as a price cut on the costs, making cars and truck insurance more affordable (Auto Insurance Agent in Jefferson GA).

Several variables influence the expenses: Age of the vehicle: Oftentimes, an older vehicle expenses less to guarantee compared to a more recent one. Brand-new vehicles have a greater market value, so they set you back even more to fix or replace.

Certain lorries consistently make the frequently swiped checklists, so you could have to pay a higher premium if you have one of these. When it comes to cars and truck insurance, the three major kinds of plans are obligation, collision, and detailed.

The Ultimate Guide To Auto Insurance Agent In Jefferson Ga

Motorbike protection: This is a policy especially for bikes since auto insurance doesn't cover bike accidents. The advantages of car insurance much exceed the threats as you might finish up paying thousands of dollars out-of-pocket for an accident you cause.It's normally better to have more protection than insufficient.

The Social Safety And Security and Supplemental Safety and security Income special needs programs are the biggest of a number of Federal programs that offer assistance to individuals with specials needs (Auto Insurance Agent in Jefferson GA). While these two programs are various in numerous ways, both are administered by the Social Safety And Security Administration and only individuals that have a disability and fulfill medical criteria might get benefits under either program

Utilize the Advantages Eligibility Screening Device to discover which programs may be able to pay you benefits. If your application has recently been refuted, the Net Allure is a beginning factor to ask for a testimonial of our decision about your eligibility for impairment benefits. If your application is refuted for: Medical reasons, you can finish and submit the Allure Demand and Appeal Special Needs Record online. A succeeding evaluation of employees' payment insurance claims and the extent to which absenteeism, spirits and employing good workers were problems at these firms shows the favorable results of offering medical insurance. When compared to services that did not supply medical insurance, it appears that using emphasis resulted in improvements in the capacity to employ great employees, reductions in the variety of workers' settlement cases and decreases in the extent to which absenteeism and productivity were troubles for emphasis organizations.

The Basic Principles Of Insurance Agency In Jefferson Ga

6 reports have actually been launched, consisting of "Treatment Without Coverage: Insufficient, Far Too Late," which locates that working-age Americans without medical insurance are extra likely to click here now get also little clinical care and get it too late, be sicker and pass away quicker and receive poorer treatment when they are in the healthcare facility, also for severe scenarios like an electric motor car collision.The research writers also keep in mind that increasing insurance coverage would likely cause a boost in genuine resource price (despite who pays), because the without insurance receive concerning fifty percent as much treatment as the independently insured. Health and wellness Affairs published the research online: "Just How Much Medical Treatment Do the Without Insurance Usage, and Who Spends for It? - Home Insurance Agent in Jefferson GA."

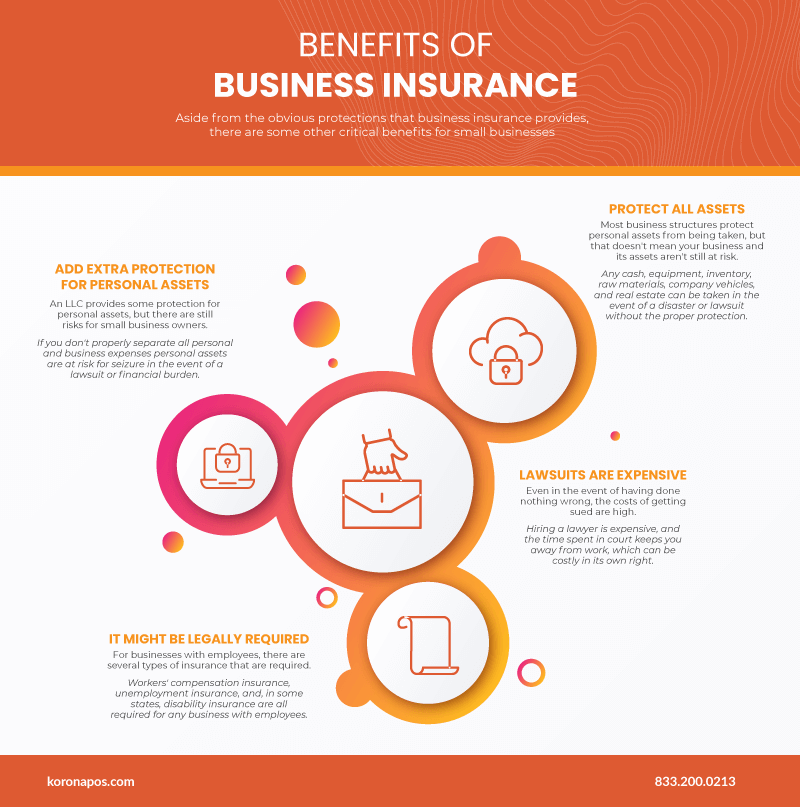

The duty of providing insurance policy for employees can be a daunting and occasionally expensive job and lots of small companies assume they can't afford it. But are advantages for workers called for? What advantages or insurance do you legally need to give? What is the distinction in between "Employee Benefits" and "Employee Insurance coverage"? Let's dive in.

Business Insurance Agent In Jefferson Ga Can Be Fun For Everyone

Worker advantages usually start with wellness insurance coverage and team term life insurance policy. As part of the wellness insurance policy bundle, an employer may choose to supply both vision and dental insurance policy.

With the increasing trend in the price of health and wellness insurance policy, it is sensible to ask employees to pay a portion of the coverage. Many companies do put most of the expense on the employee when they offer accessibility to medical insurance. A retirement (such as a 401k, easy strategy, SEP) is usually supplied as a fringe benefit too - http://prsync.com/alfa-insurance---jonathan-portillo-agency/.

Report this wiki page